Key Facts

- ✓ Venezuela possesses the world's largest proven oil reserves, yet its production has collapsed to historical lows due to mismanagement and sanctions.

- ✓ Iran holds significant production capacity that can rapidly influence global supply balances, making it a critical swing producer.

- ✓ The Strait of Hormuz, located adjacent to Iran, facilitates the transit of approximately 20% of the world's oil consumption.

- ✓ Markets have largely priced in Venezuela's decline as a known, chronic issue, whereas Iran represents an unpredictable variable with potential for sudden shocks.

Market Disparity

Global oil markets demonstrate a striking divergence in their response to two major energy producers facing crises. While the slow-motion collapse of Venezuela's oil industry barely registers as a blip on trading screens, the mere possibility of disruption in Iran sends ripples of anxiety through energy corridors.

This asymmetry reveals deeper truths about how markets assess risk. It is not merely about current production volumes, but about potential shock, geopolitical leverage, and the ability to rapidly alter global supply dynamics.

The contrast between these two nations highlights a fundamental principle in energy economics: uncertainty often outweighs reality. A predictable decline, however severe, is easier to price than an unpredictable escalation.

The Venezuela Factor

Venezuela once stood as a titan of oil production, boasting the world's largest proven reserves. Today, its industry is a shadow of its former self, crippled by years of mismanagement, underinvestment, and international sanctions. Despite the magnitude of this decline, markets have largely priced in Venezuela's reduced role.

The country's output has been in freefall for years, a chronic condition rather than an acute crisis. Traders view this as a known quantity—a persistent drag on supply, but not a catalyst for sudden price shocks. The market has adapted to a world where Venezuelan barrels are scarce.

Key factors insulating markets from Venezuela's woes include:

- The gradual nature of the decline

- Availability of alternative suppliers

- Limited impact on short-term supply balances

- Pre-existing sanctions regime

Essentially, the damage is done. The question is no longer if Venezuela will produce, but rather how little it will contribute to the global pool.

The Iran Wildcard

In stark contrast, Iran represents a high-volatility asset in the global energy portfolio. The nation remains a heavyweight producer with the capacity to significantly swing global supply. It is this latent potential—and the threat of its sudden removal—that keeps markets on edge.

The anxiety stems from two primary sources: internal instability and external geopolitical pressures. Unlike Venezuela's managed decline, Iran's situation is volatile and subject to rapid change. Any escalation could remove millions of barrels from the market almost overnight.

Market participants are particularly sensitive to:

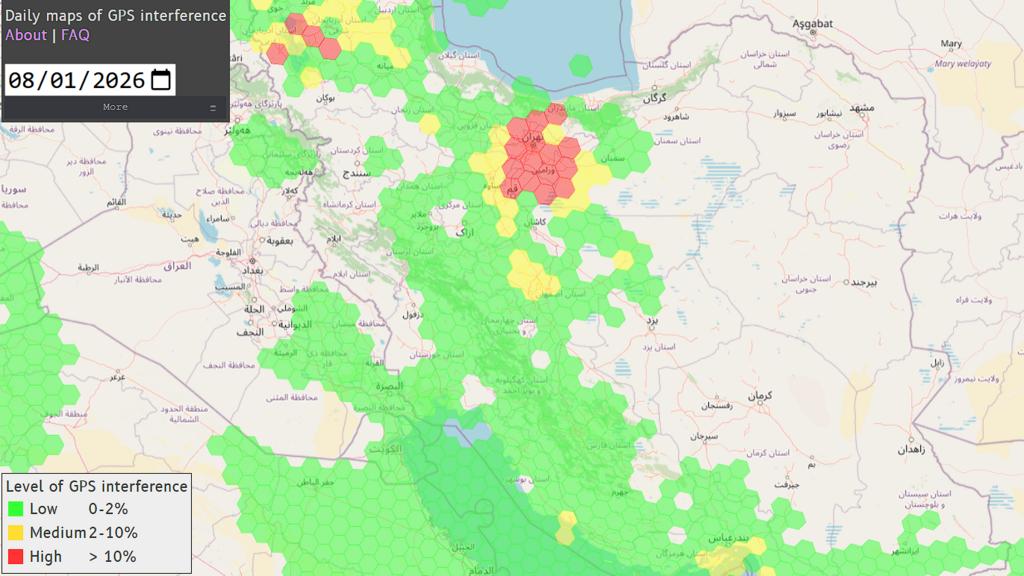

- Geopolitical tensions in the Strait of Hormuz

- Potential for renewed sanctions enforcement

- Internal political instability affecting infrastructure

- The return or removal of Iranian barrels from official trade flows

The market is pricing in the risk of a sudden supply shock, not just the current production numbers.

This forward-looking anxiety drives hedging behavior and price premiums, making Iran's fate a constant variable in energy risk models.

Risk Asymmetry

The core difference lies in the nature of the risk. Venezuela presents a downside risk that is already realized; the market knows exactly how bad the situation is. Iran presents a tail risk—a low probability, high impact event that could destabilize the entire system.

Consider the mechanics of supply disruption. Venezuela's production cannot fall much further from its current depths. Iran, however, has significant capacity that could be taken offline. Conversely, if tensions ease, Iran could theoretically flood the market, though this is viewed as less likely.

Markets function as insurance mechanisms against the unknown. The premium attached to Iranian supply stability reflects the following realities:

- Scale of production at risk

- Geographic concentration of risk

- Lack of immediate substitutes

- Potential for cascading geopolitical consequences

While Venezuela's crisis is a tragedy for its people, it is a closed chapter for traders. Iran remains an open book with unpredictable plot twists.

Global Implications

The differing market reactions underscore the interconnected nature of modern energy security. A disruption in one region does not occur in a vacuum; it ripples through refining complexes, shipping routes, and consumer economies worldwide.

Iran's strategic position near critical maritime chokepoints amplifies its importance. The Strait of Hormuz, through which a significant portion of the world's oil passes, lies adjacent to Iranian territory. Any conflict that threatens this artery threatens global commerce.

Furthermore, the psychological impact of Iranian instability cannot be overstated. Energy markets are driven as much by sentiment and fear as by physical barrels. The mere threat of conflict drives speculative positioning and inventory builds, creating self-fulfilling price movements.

For oil-importing nations, the lesson is clear: diversification is not just a strategy, but a necessity. Over-reliance on any single region—especially one as volatile as the Middle East—exposes economies to unacceptable levels of risk.

Looking Ahead

The divergence in market attention between Venezuela and Iran serves as a masterclass in risk assessment. It demonstrates that in energy markets, geopolitical volatility often trumps chronic structural decline.

As long as Iran remains a geopolitical flashpoint with significant production capacity, its fate will remain a primary driver of oil price sentiment. Traders will continue to monitor headlines from Tehran far more closely than statistics from Caracas.

Ultimately, this dynamic reflects a search for stability in an inherently unstable market. Until the risks surrounding Iran are resolved—either through normalization or permanent structural change—markets will continue to price in a premium for peace in the Persian Gulf.