Key Facts

- ✓ Physical coercion attacks on crypto users, known as 'wrench attacks,' reached unprecedented levels in 2025, with at least four fatalities reported.

- ✓ Casa, founded in 2018, targets users securing meaningful Bitcoin amounts—typically five figures or more—where financial freedom outweighs convenience.

- ✓ Regulatory changes in 2025, including the rescission of SAB 121, removed capital penalties for crypto custody, making it more practical for banks to hold digital assets.

- ✓ France emerged as a hotspot for wrench attacks in 2025, with at least 10 reported incidents often linked to tax reporting and data exposure.

The Sovereignty Paradox

As Bitcoin enters 2026, the asset class finds itself at a crossroads. Sustained institutional adoption and price stability following the 2024-2025 bull run have cemented its place in traditional finance, yet the core promise of self-custody remains a fiercely debated topic.

The landscape has evolved dramatically. On one hand, Spot Bitcoin ETFs have unlocked passive investment for a broad new userbase comfortable with Wall Street’s brokerage models. On the other, a disturbing surge in physical attacks on crypto holders has cast a dark shadow over the industry.

In a candid interview, Casa CEO Nick Neuman addressed these dynamics, arguing that self-custody is not a relic of the past but a transforming necessity. His company’s multisig solutions aim to bridge the gap between pure sovereignty and practical usability for high-value holders facing modern security challenges.

The Rise of Institutional Self-Custody

While retail investors flock to the convenience of ETFs, a counter-movement is gaining traction among sophisticated players. Institutions such as family offices, corporations, and investment funds are increasingly recognizing the risks of outsourcing their Bitcoin custody to third parties like Coinbase.

Neuman revealed that Casa has seen a significant uptick in institutional clients seeking provable security and control. "Increasingly over the last year, Casa is helping large institutions that need to have provable security and provable control to secure their assets," he stated.

This shift is partly driven by regulatory clarity. The OCC has allowed national banks to custody crypto assets, and the SEC’s rescission of SAB 121 removed capital penalties for custody. Major banks like JPMorgan and Citi are now developing their own independent custody platforms.

"At scale, you simply can’t afford to trust that Coinbase or anyone else is getting every process right."

Defending Against Wrench Attacks

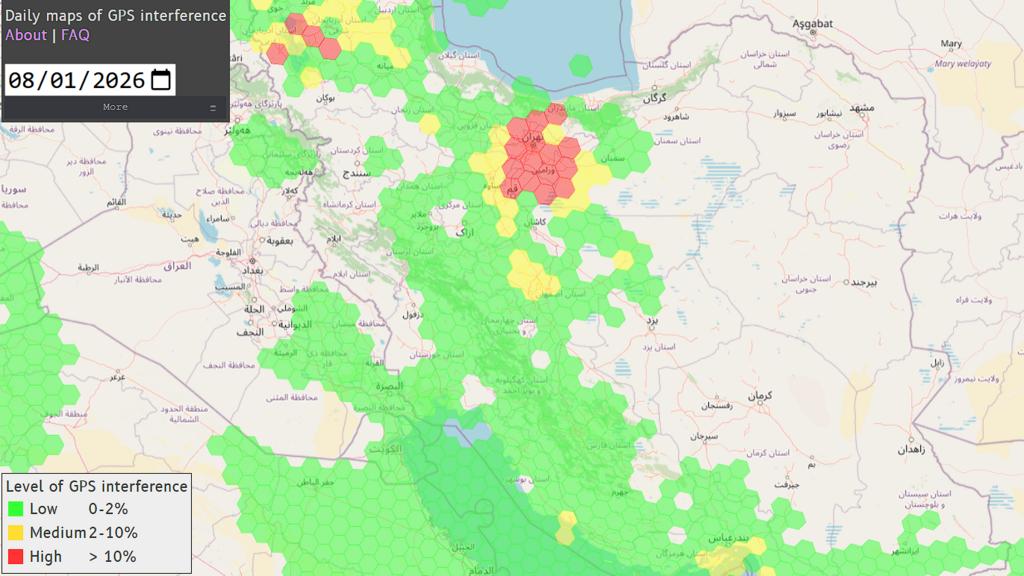

The need for robust security has never been more urgent. Physical coercion attacks, infamously dubbed "$5 wrench attacks," reached unprecedented levels in 2025. Jameson Lopp, Casa’s chief security officer, documented approximately 65–70 incidents, the highest on record, with at least four fatalities.

Alena Vranova, co-founder of Trezor, places the figure even higher at 292 incidents. These attacks are not random; they are often targeted. France emerged as a hotspot, with at least 10 reported attacks linked to tax reporting that potentially exposed user addresses and identities.

The United States leads in total numbers of known crypto-related attacks. However, Casa’s multisig technology offers a technological defense. By requiring multiple keys to sign a transaction, it ensures that even if a user is physically compromised, a single key does not grant access to the full treasury.

- Multisig requires multiple keys for transaction authorization

- Enables key rotation for personnel changes

- Provides auditability for institutional compliance

- Distributes geographic risk of asset seizure

The Swiss Bank for Individuals

Casa’s philosophy is rooted in the concept of the sovereign individual. Founded in 2018, the company targets users securing meaningful Bitcoin amounts—typically five figures or more—who prioritize financial freedom over convenience.

Neuman describes Casa’s "north star" as maximizing sovereignty and security through Bitcoin and private key cryptography. This vision has solidified into a mission to build the "Swiss bank for the sovereign individual"—a service for those who view money as integral to personal autonomy.

However, Neuman acknowledges the friction in this model. "Not everyone wants to be a sovereign individual right now," he noted, pointing to the high personal responsibility and technical competence required for true self-custody. The challenge remains designing systems that resist nation-state intrusions while maintaining usability.

"Building the Swiss bank for the sovereign individual—a service for those who view money as integral to personal autonomy."

The Future of Custody

The tension between convenience and control is shaping the future of the Bitcoin ecosystem. As ETFs cater to the passive majority, the infrastructure for active self-custody is maturing to serve the high-agency minority.

For institutions, the ability to rotate keys during personnel changes without compromising the entire treasury is a game-changer. "If someone who controlled a key leaves, you can rotate that key out completely," Neuman explained. "We make that process straightforward, and for institutions, we’ve added extra guardrails, auditability, and visibility."

We are likely witnessing the beginning of a bifurcated market: one stream flowing toward custodial bank-like services, and another toward decentralized, user-controlled security. The evolution of self-custody is not about returning to the early days of complexity, but about building sophisticated armor for a high-stakes financial world.

Key Takeaways

The state of Bitcoin self-custody in 2026 is defined by a maturation of risk and reward. It is no longer a binary choice between total chaos and total control, but a spectrum of options tailored to different needs.

1. Institutional Demand is Rising: Large entities are moving away from outsourcing custody to single vendors, seeking provable control to satisfy regulators and mitigate counterparty risk.

2. Physical Security is Paramount: The record spike in wrench attacks proves that digital security alone is insufficient; physical operational security is now a mandatory component of crypto ownership.

3. Technology is Adapting: Solutions like Casa’s multisig are evolving to offer the security of a fortress with the usability required for complex organizational needs, proving that sovereignty and usability can coexist.